Clients Often Come To Us With Questions About Market Trends — Will The Bear Market Dominate Or Will The Bull Market Prevail? Given The Volatile Market Conditions Of The Past Few Years, These Concerns Are Easy To Understand.

1. 401k Advisors Help You Decipher Your Current Plan

Before you start the 401k rollover process, meet with your 401k advisor to discuss your options. Bring your current plan’s most recent statement and documentation with you, so you’ll know:

- Your current balance

- How much you’ve contributed

- How much your employer matched

- Your account’s growth

You should also contact your plan administrator and have them walk you through the 401(k) rollover process. Your advisor will work with you to identify which funds your account is invested in the portfolio and its associated growth patterns.

”

Your advisor will work with you to identify which funds your account is invested in and its associated growth patterns.

The question of bear vs bull markets is incredibly common. We’re happy to inform our clients that market history offers good news: Bull market cycles last longer than bear market cycles. But that’s not all — bull markets also produce cumulative gains that more than offset bear market losses. Here’s the lowdown.

Wealth Planning: Know Your Definitions And Methodology

First, what makes a bear a bear? Bear markets are identified in hindsight and are defined as such when the market meets two conditions:

- Daily negative return

- Cumulative loss of at least 10%

Bear markets end at their low point. Bull markets are a bit easier to quantify; they simply include everything not considered a bear market.

Overall, the picture is clear: Bull markets last longer and deliver disproportionately greater returns.

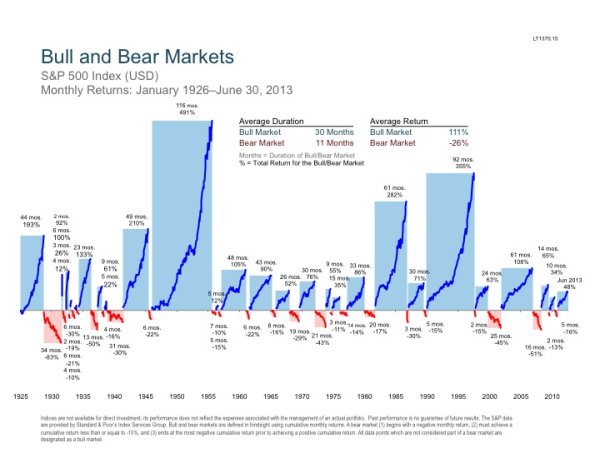

S&P 500 Monthly Returns And Your Financial Plan

From January 1926 to June 2013, S&P 500 monthly returns reflect the same trends as daily returns. Specifically, the average duration of bull markets was 30 months, beating the bear market’s average 11 month duration. Bull market average returns triumphed at 111%, as compared to bear markets’ -26%.

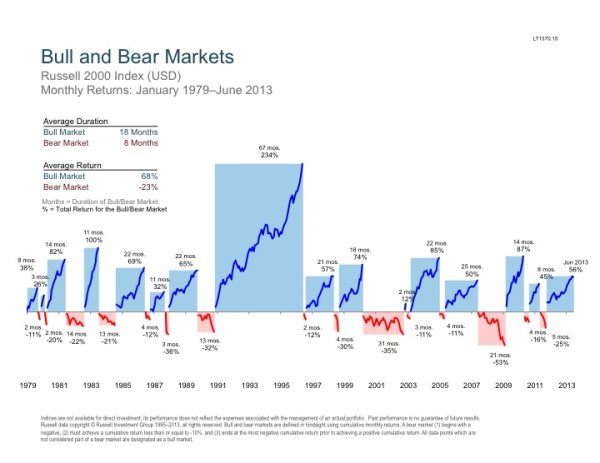

The Russell 2000 Index And Investment Planning

Now let’s look at the Russell 2000 Index — which measures small-cap equities — from January 1979 through June 2013. The numbers reflect the relative strength of bull over bear markets, with bulls’ average duration of 18 months to bears’ 8 months, and bulls’ average return of 68% as compared to bears’ -23%. And the bull triumphs again.

Plan Your Wealth Management Strategies

From this data, you and your wealth advisor can conclude that:

1. Since 1926, bull markets have lasted longer and delivered greater price gains than bear market losses

2. Each trend experiences fluctuating performance, underlying the difficulty of accurately predicting market cycles

3. An investment guidance approach based on the long-term makes more sense than emotional reactions to short-term movements, as some personal financial advisors may advocate

Overall, the picture is clear: Bull markets last longer and deliver disproportionately greater returns. While index performance can — and will — fluctuate, the rational investor takes a disciplined, long-term approach and avoids making ill-timed decisions in reaction to (inevitable) market volatility.